Telegram is no longer only for chats. Many people now use it to buy courses, pay for subscriptions, tip creators, and pay inside bots or mini apps. That raises an important question: Is Telegram payments safety strong enough for my business?

Is the Telegram payment system really secure? What risks stay on the user side? And how can creators monetize safely?

This guide explains secure Telegram payments, real risks, and the best ways to protect both Telegram-based businesses and users.

What Are Telegram Payments?

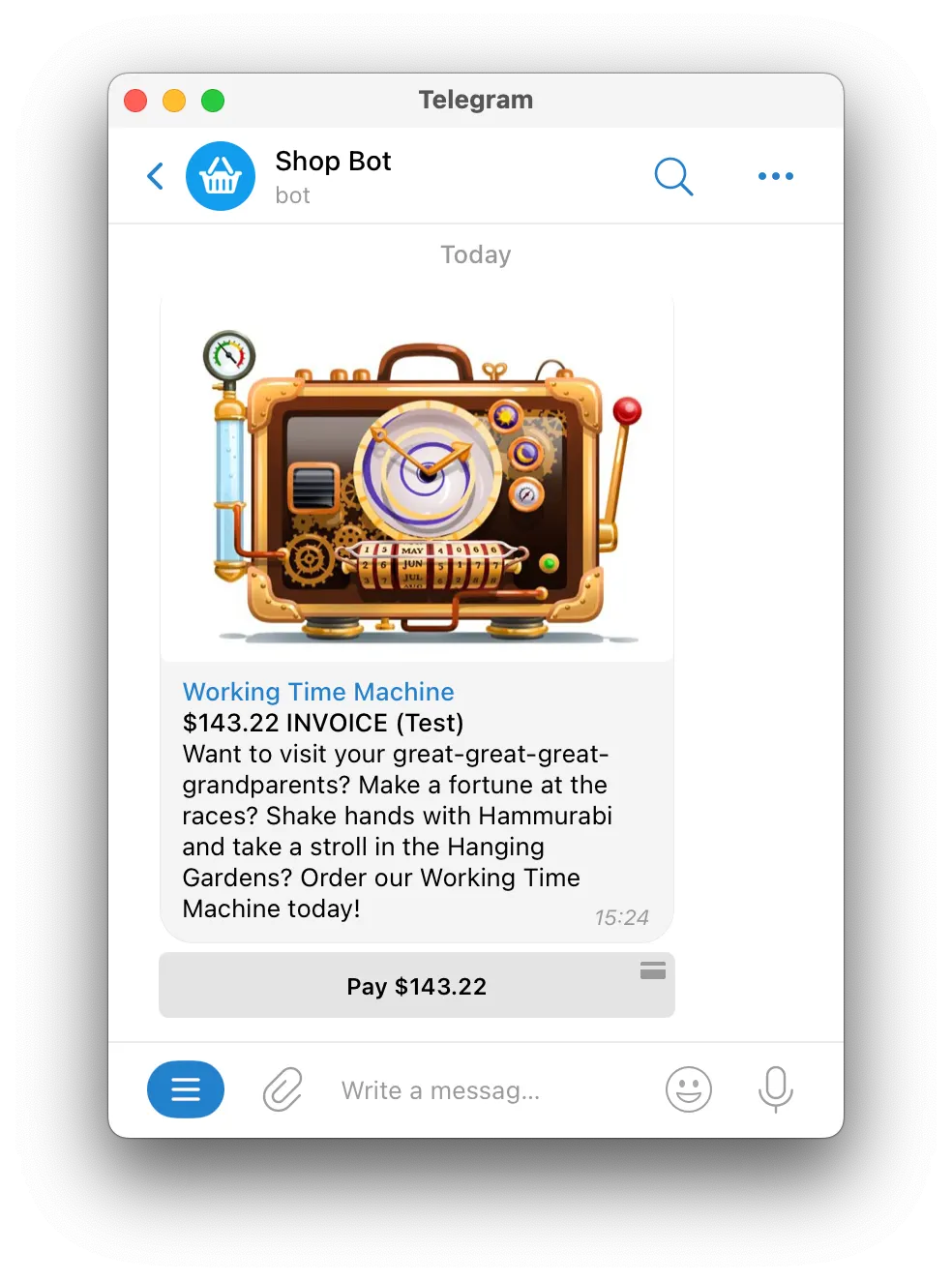

Telegram payments run through the Telegram Payments API, which lets users pay inside chats via bots or mini apps. In practice, a bot sends an invoice, Telegram opens a payment window, and an approved payment provider completes the transaction.

Setting up the Payments API usually requires technical expertise (or a developer), and many native payment options are region-restricted or unavailable to individuals. InviteMember lets creators accept cards, crypto, or Telegram Stars in a few clicks or taps—no coding needed.

Creators who charge for access to a Telegram channel or group typically use one of two routes. In any case Telegram and InviteMember neither store nor processes card data, which is a key part of Telegram payments safety.

Telegram Payment Methods

Telegram supports several Telegram payment methods, but they don’t appear automatically. Before any method is available, a creator (or developer) has to set up a payment flow inside a bot or mini app.

In general, Telegram payments work through:

- Card payments via official payment providers. These providers handle bank cards directly, and many also enable Apple Pay or Google Pay, depending on what’s available in the user’s region and on that provider’s side.

- Telegram Stars for digital goods and services. Stars are Telegram’s in-app currency used for things like tips, digital content, and mini-app purchases, and they’re designed to work across platforms.

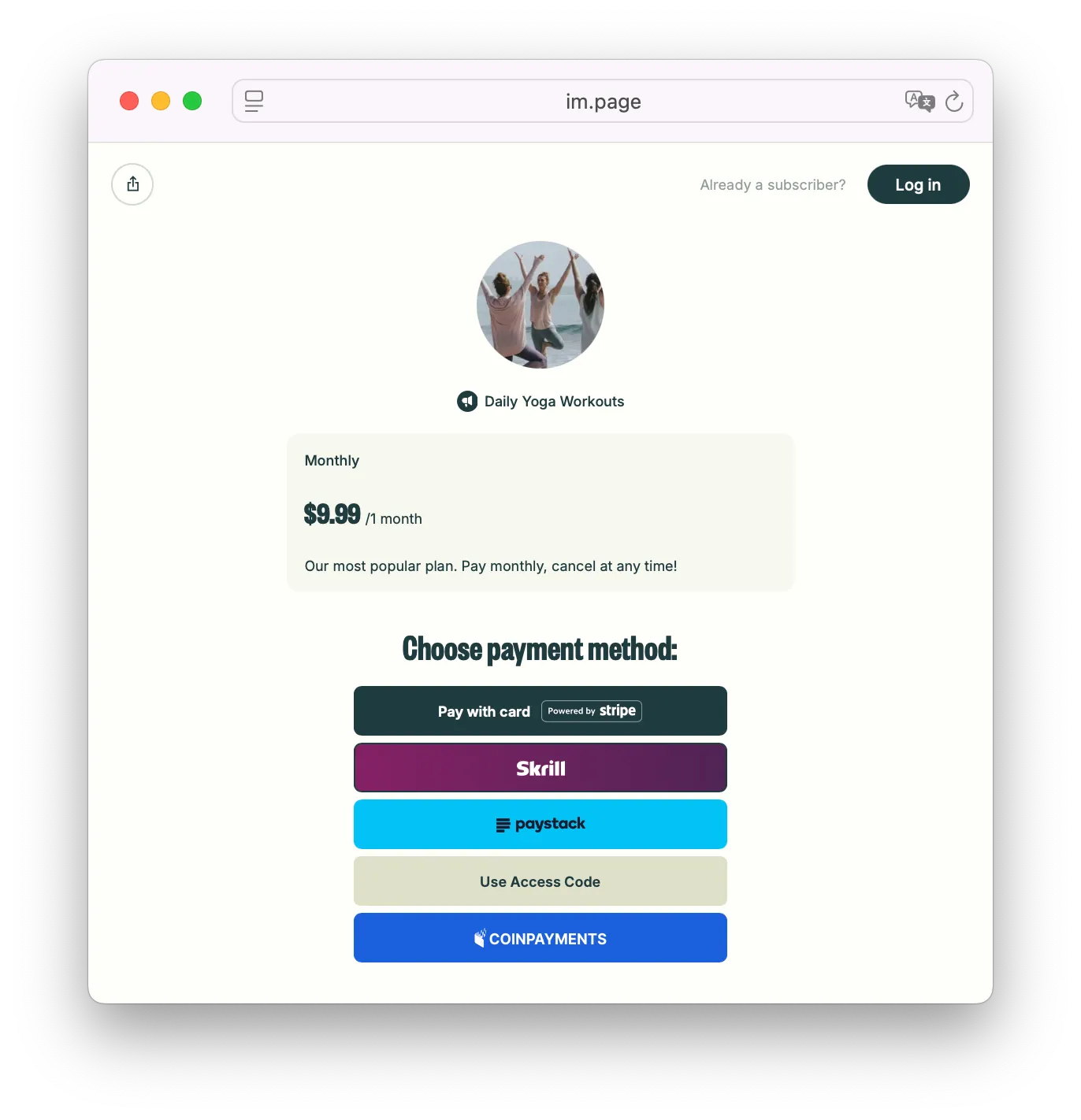

InviteMember Payment Options

InviteMember lets creators accept recurring and not recurring payments through these options:

Global providers

- Stripe: credit/debit cards, plus any Stripe-enabled wallets and local methods you turn on in Stripe (e.g., Apple Pay, Google Pay, Klarna, iDEAL, Bancontact, WeChat Pay, etc.).

- PayPal: PayPal balance, cards via PayPal checkout, and bank direct debit where PayPal supports it (also PayPal Credit/Rewards in some regions).

- Skrill: Skrill/Neteller wallets, cards, 100+ local payment methods, and many direct bank-transfer options (availability depends on country).

- CoinPayments (crypto): Bitcoin, Ethereum, and thousands of other cryptocurrencies.

Country-specific providers

- Razorpay (India): domestic/international cards, UPI, netbanking, EMI, and supported mobile wallets.

- Paystack (Nigeria, Kenya, South Africa, Ghana): cards, bank accounts, and local rails like Visa QR / GTB 737.

- Stripe-based local methods: e.g., iDEAL (Netherlands) and Multibanco (Portugal) once enabled in your Stripe dashboard.

In-Telegram / manual options

- Telegram Stars: in-app Stars payments for digital goods/services; can be used alone or alongside other methods.

- Access Codes: you take payment off-platform (cash, bank transfer, etc.) and give the user a code to unlock access.

How Telegram Keeps Payments Secure

People worry about safety when money enters a chat. Telegram makes secure Telegram payments possible mainly through design choices in the Payments API — and services like InviteMember add another safety layer by keeping payments provider-first and data-minimal.

1. Telegram and InviteMember do not touch card data

Card details never reach Telegram or InviteMember’s servers. The payment provider stores and processes them, while Telegram only displays the payment window.

2. Payments go through verified providers

Telegram and InviteMember only support established processors (e.g., Stripe, PayPal, Skrill, CoinPayments, Razorpay, Paystack), and users enter payment details directly in those providers’ secure checkouts only.

3. Account protection tools

Telegram supports two-step verification and session control. If your account is protected, your payment access is also protected.

4. Telegram Stars security rules

Stars are tied to your Telegram account. If you earn Stars as a creator, you can withdraw them and convert them to TON via Fragment, giving you a crypto-based payout option.

5. InviteMember keeps payments provider-first

InviteMember doesn’t collect or process card data either. When creators use card or crypto processors through InviteMember, members enter payment details directly in the provider’s checkout, and the provider handles all sensitive information. InviteMember only receives the minimum transaction status needed to automate access.

Important note: Telegram and InviteMember secure the payment flow, but they don’t verify every seller. If something goes wrong, disputes are handled with the seller or the payment provider.

Common Security Risks and Misconceptions

“Telegram or InviteMember stores my card details.”

False. The provider stores card data, not Telegram or InviteMember.

Fake bots and scam sellers

Telegram is open, so scammers can create bots that look real. If a bot asks you to type card data inside chat, it is a scam. Real payments always open a secure provider window.

Phishing links

Scammers copy Telegram branding and send fake payment pages. Always check the domain before paying.

“Telegram is unsafe for business.”

Telegram’s system is secure. Risk comes from businesses using untrusted bots or unverified providers. The tool is safe, but a bad setup is not.

Human mistakes

Most payment problems come from clicking wrong links, sharing passwords, or trusting unknown sellers.

Refunds and Chargebacks: What to Expect

Refunds depend on the payment provider and the seller, not on Telegram or InviteMember. Neither platform reverses payments on its own; disputes and chargebacks are handled through the provider.

For Telegram Stars, the rules are stricter. Stars are primarily for digital goods, and refunds are limited: bots can issue Stars refunds in specific cases, and app-store refunds or policy actions can lead to Stars being deducted.

How to Protect Yourself When Using Telegram Payments

- Confirm who you are paying: Use trusted channels, known bots, or paid communities you already joined.

- Never share card details in chat: If anyone asks for a card number inside messages, stop.

- Use official providers only: The payment window should show a real provider domain.

- Turn on two-step verification: This blocks most account takeovers.

- Check links carefully: Look for spelling tricks and strange domains.

- Keep Telegram updated: Updates include security fixes.

- Use strong unique passwords: Do not reuse passwords from other apps.

- Review active sessions: If you see a login you do not recognize, end it and change your password.

Why InviteMember Makes Paid Payments Safer

If you run paid channels or groups, your goal is safe access plus stable income.

InviteMember helps because:

- You can connect common payment methods fast, without building custom bots.

- InviteMember automates access after payment, so owners do not need manual checks.

- Providers still handle card data, so Telegram payments safety stays strong.

- You can add Stars or card payments depending on what your audience prefers.

This is a clean way to keep Telegram transactions safe while growing a paid community. Beware of other untrustworthy, shady InviteMember imitations.

In Short

Telegram payments are safe when used correctly. The Telegram payment system protects users by sending payments through verified providers and by never storing card details.

But safety also depends on user behavior: avoid fake bots, ignore phishing links, and protect your account.

For creators and community owners, safe payments are also a growth tool. Using InviteMember lets you monetize with secure payment flows and automatic access, so you can focus on content and retention.

If you follow the rules above, you can use Telegram confidently for both personal purchases and paid community income.

![The Truth About Telegram Payments Safety [2026]](/content/images/size/w2000/2025/11/Telegram-payments-safety.png)